Bullish analysts believe ExOne is at a turning point their consensus outlook is that revenues will double by year-end 2023 while the company's operating loss becomes more manageable. Over the past few years, it has generated about $50 million in annual revenue while running sizable net losses.

The reason for ExOne's uncertainty is clear: It's a small firm that designs and manufactures 3D printing machines. Trading volatility has been elevated, as well: The stock surged from $10 to $70 over the past 12 months but has fallen back to $24. Short sellers have hounded the firm, and nearly 9% of the float is sold short. That'd be great news for these six 3D printing stocks to buy.ĮxOne is one of the most controversial 3D printing stocks. However, 3D printing stocks have taken off in recent months, and this looks like a potential inflection point where the technology finally reaches the mainstream. Investors may have written it off, given that the flagship 3D Printing ETF (ticker: PRNT) has dramatically underperformed the S&P 500 and tech stocks in recent years. As commercial adoption of 3D printing grows, the potential marketplace for stocks in this industry grows with it. Furthermore, the pandemic disrupted supply chains, elevating the utility of on-site manufacturing options for key parts. Now industries including manufacturing, education and health care are starting to incorporate the unique versatility of 3D printing into their workflows. In recent years, however, 3D printing has rapidly gained commercial adoption. Many have long dismissed it as a mere hobby, a niche for a few people with too much time on their hands. No one does that.Ī better idea is to follow the information available publicly and make your move when the signs look right.Supply chain issues have given the 3D printing industry a major opportunity.ģD printing is a promising technology platform.

Best 3d printing stocks full#

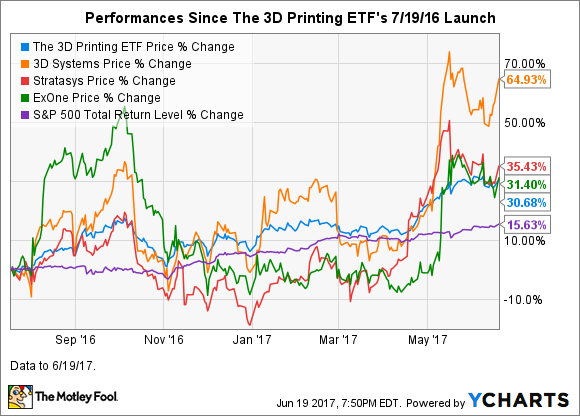

You can see in the chart many opportunities for buying and selling to make more money in shorter time periods than a full year.Īnd that brings me to my last point: while this analysis is from 1 Jan to 31 Dec, it’s not clear to me who exactly would buy and sell a stock on those exact days.

That requires you to carefully watch the situation and make your buy or sell move at just the right time. The key to investing, as should be obvious, is to buy low and sell high. Also you’ll see some precipitous falls later in the year for some companies, generally after their financial announcements. If you look at the chart above, it’s clear there was not much happening until May 2017, when things jump around a bit. However, there is no guarantee of which 3D printer they will buy, hence the problem for investors seeking a 3D printer manufacturer investment.īut there’s another thing to note here: stock prices rise and fall quite variably throughout the year. 3D print services also can more easily ride the increasing interest in the technology than an individual 3D printer manufacturer.Īs 3D print services grow, they are likely to buy more 3D printers for their factories. While individual 3D printer manufacturers rise and fall on their new product announcements and financials, 3D print services need only provide good services to their clients to grow. It seems investors like 3D print services, and it makes sense to me. But what can we specifically tell from these results? This sort of analysis is interesting in that it can demonstrate the overall feeling of investors towards these companies.

In other words, a random stock would have likely done as well as Stratasys. However, the S&P index, which represents the average of many stocks, ranked at a 21.83% Gain for 2017, meaning Stratasys was about even. Two companies, ExOne and 3D Systems, would have lost you money if you bought and held them during 2017. They tracked the primary 3D printing-related stocks, including: Proto Labs and Materialise (3D print service bureaus), and Stratasys, 3D Systems, voxelJet and ExOne (3D printer manufacturers) against the Standard & Poors total return index for 2017. The results are somewhat interesting, but also not so interesting. The idea here was to check the value of various 3D printing-related publicly traded stocks at the beginning of 2017 and then compare them to how they closed at year end. I’m reading a post on about their measurement of the best 3D printing stocks during 2017.

0 kommentar(er)

0 kommentar(er)